Before taking about federal scapia credit card review, let us first understand the need for credit cards and its benefits.

Why do we need credit cards?

Credit cards aren’t just plastic power, especially the Federal Scapia Credit Card.

They’re handy financial tools offering a bundle of benefits you wouldn’t have with cash alone.

Here’s why they matter:

- Build Credit Score: Responsible credit card use helps build a healthy credit score, crucial for future loans, mortgages, and even career opportunities.

- Convenience & Security: Ditch bulky cash! Swipe for everything from groceries to flights, enjoying enhanced security with chip encryption and fraud protection.

- Rewards & Cashback: Earn points, miles, or cashback on everyday spending – free flights, gadgets, even bonus points to fuel your shopping dreams.

- Emergency Backup: Unexpected car repair? Credit cards offer a safety net, avoiding scrambling for cash in a pinch.

- Purchase Protection: Certain cards offer extended warranties, insurance on accidental damage, and purchase protection against theft.

While responsible usage is key, credit cards can be powerful allies, unlocking benefits and building financial security.

So, swipe wisely, reap the rewards, and watch your financial power grow!

About- Federal Scapia Credit Card

As the name suggests, Federal Scapia Credit Card is a collaborative effort between Scapia credit card & Federal Bank, with the backend operations overseen by Federal Bank, and the frontend operations managed by Scapia.

In the world of credit cards, where there are tons of choices, the Federal Scapia Card is like a bright light/ spot.

It’s flexible and lets you earn rewards in different ways, which is why lots of people are interested in it.

So, let’s take a closer look at what makes this card special and how it can help you manage your money better and maybe even get some free stuff!

ALSO READ: Best Neo Banks In India- A Personal Guide

Federal Scapia Credit Card Benefits

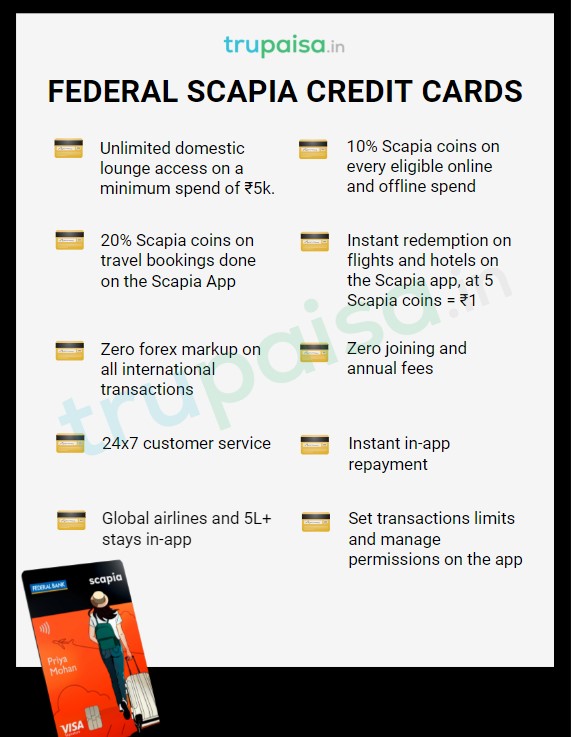

If you are a travel lovers, Federal Scapia Credit Card Benefits is just made for you.

Using this card you can you can convert your everyday expenses into a wonderful travel experiences.

Before jumping into the details, here are few prime benefits of using Federal Scapia credit card.

- Zero joining fee

- Zero annual fee, &

- Zero forex fee

- Unlimited domestic lounge access

- Earn 10% Scapia coins on all online and offline spending

- Save 20% on travel bookings.

- Access to 24×7 concierge service

- Zero foreign transaction fee

- Earn unlimited Scapia coins

- Convert travel expense through Scapia App into 3 month no-cost EMI

- Unlimited domestic airport lounge access

- Reward rate: 2%-4%

And the detailed benefits of Federal Scapia Credit Cards is as under:

The Federal Scapia Credit Card sets itself apart with a variety of distinctive features aimed at improving the financial well-being of its users.

Ranging from a robust rewards program tailored to diverse preferences to competitive interest rates and enticing introductory offers, this credit card provides a comprehensive array of advantages.

Rewards Program

At the heart of the Federal Scapia Credit Card experience is its rewards program.

Tailored to add tangible value to everyday spending, this program encompasses a variety of perks, including cashback options, travel rewards, and other enticing benefits.

This flexibility allows cardholders to personalize their rewards, aligning them with individual preferences and lifestyle choices.

Competitive Interest Rates

Recognizing the financial ramifications of credit card usage is crucial, and the Federal Scapia Credit Card tackles this issue with competitive interest rates.

Notably, the favorable rates during introductory periods make this card an appealing choice for individuals seeking efficient and cost-effective financial management.

Annual Fees and Introductory Offers

Delving into the financial structure of the Federal Scapia Credit Card, prospective users will find a transparent breakdown of annual fees and enticing introductory offers.

Evaluating these aspects is essential for individuals looking to maximize the benefits and immediate advantages associated with owning this credit card.

User Experiences and Acceptance

As with any financial instrument, real-world user experiences offer valuable insights.

Examining customer reviews, testimonials, and feedback contributes to a holistic understanding of the day-to-day usability, customer service, and overall satisfaction that the Federal Scapia Credit Card delivers.

Additionally, exploring the card’s acceptance, both domestically and internationally, ensures that it aligns seamlessly with diverse spending habits.

ALSO READ: Importance of Personal Finance Planning

Eligibility Criteria Of Federal Scapia Credit Card

The eligibility criteria for the Federal Scapia Credit Card encompass various factors, including:

Age: Applicants must be a minimum of 18 years old.

Nationality: Eligibility is open to Indian residents.

Income: Applicants need to meet a minimum annual income requirement, which stands at:

- Rs. 2.5 lakhs for salaried individuals

- Rs. 3 lakhs for non-salaried individuals

Credit Score: A favorable credit score, typically above 750, is preferable.

Other Factors: Consideration may also be given to factors such as employment status, existing loans and debts, and past credit history.

Additional details for specific applicant categories include:

- Salaried Individuals: Submission of salary slips and bank statements for the past three months is required.

- Non-Salaried Individuals: Proof of income, such as Income Tax Return (ITR) documents or business income proof, is necessary.

- Self-Employed Individuals: Depending on the nature of self-employment, additional documents like business registration papers or audited financial statements may be requested.

Note that these are general guidelines; specific eligibility criteria may vary based on the institution’s policies and individual circumstances.

For the latest and most accurate information on eligibility and the application process, it’s best to contact the institution directly or visit their official website.

Some banks also provide eligibility calculators or pre-approval tools for insights into approval likelihood based on individual financial situations.

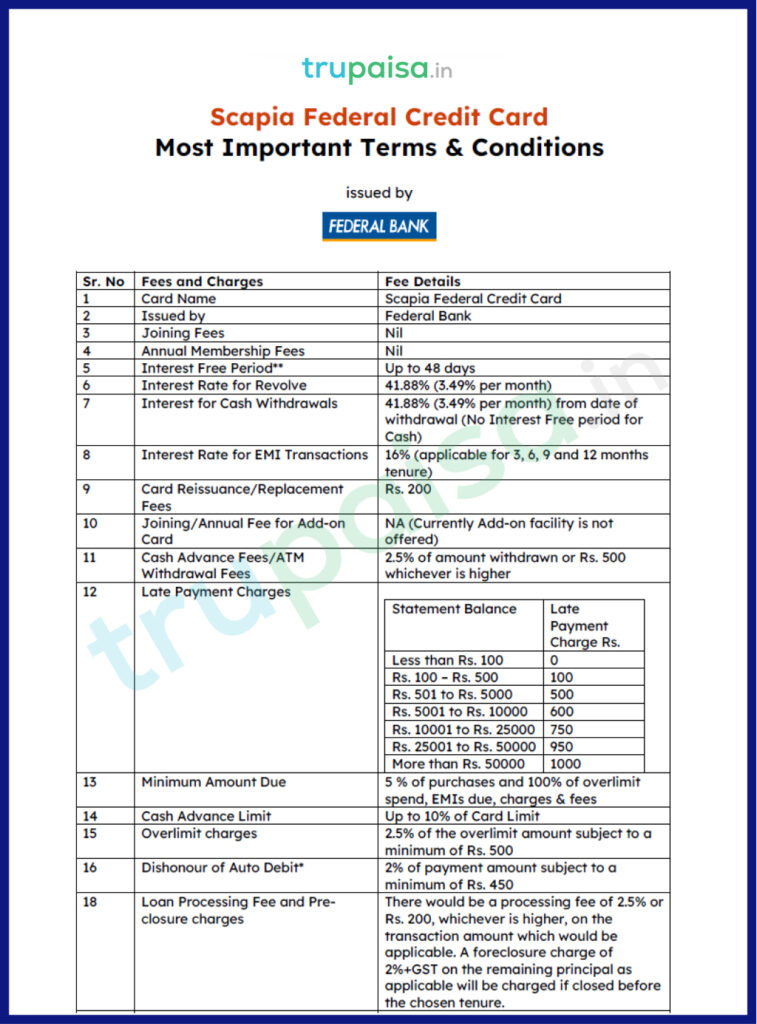

Charges- Federal Scapia Credit Card

There are many charges related to Federal Scapia Credit Card, some of them are fixed whereas some are variable in nature.

Details of the same are as under:

Fixed Charges

- Annual Fee: Rs. 499 (charged yearly)

- Account Opening Fee: Rs. 200 (one-time charge)

- Late Payment Fee: Rs. 100 + 2% of outstanding dues (charged for delayed payments)

- Over-limit Fee: Rs. 250 (charged if you exceed your credit limit)

Variable Charges

- Interest Rate: Annual Percentage Rate (APR) varies depending on your credit score and ranges from 13.99% to 15.99% (charged on unpaid balances)

- Foreign Currency Markup: 0% (no markup charges on international transactions)

- GST: Applicable on all fees and charges

Few more points to consider:

- Minimum Spend Requirement: To avail the benefit of free airport lounge access, you have to spend minimum Rs. 5,000 per month.

- Reward Program: You can earn loads of Scapia Coins as you incure your daily expenses. This can be redeemed later on for several travel and related beenfits.

- Cash Advance Fee: 2.5% + Rs. 50 (charged for cash withdrawals using the card).

Overall, if you notice, the Federal Scapia Credit Card has a relatively low annual fee compared to other travel-focused cards.

However, its important to keep a tab of other variable charges such as late payment fees, etc. so that you can unnecessary costs burdens.

Besides this, we need to be mindful & be judicious of our spending habits so that we can manage Federal Scapia credit card wisely.

How to contact issuer of Federal Scapia Credit Card?

For all your queries related to Federal Bank -Scapia co-branded credit cards, you call them at 080-48675100.

You can also email them at cobrandedcards@federalbank.co.in

If you are keen visit office directly, address is as under:

Federal Bank, Fintech Partnership Department, Kerala

Technology Innovation Zone, Kinfra Hi-Tech Park Main Rd, HMT Colony, P.O,

Kalamassery, Kochi, Kerala 683503

Conclusion

The Federal Scapia Credit Card emerges as a compelling option in the competitive credit card market, promising a blend of rewards, competitive interest rates, and user-friendly features.

As we navigate through the intricacies of this financial tool, prospective cardholders are encouraged to conduct a thorough analysis of their unique financial needs and preferences.

By doing so, individuals can ascertain whether the Federal Scapia Credit Card is not just a card but a tailored and rewarding financial companion that aligns seamlessly with their financial journey, especially of a traveler.

FAQs

Is Federal Scapia credit card life time free?

No, the Federal Scapia isn’t free forever.

While it boasts zero forex fees and generous travel rewards, you’ll pay an annual charge of Rs. 499.

Think of it as an “entrance fee” for the reward club! Plus, you need a minimum monthly spend for perks like airport lounge access.

So, it’s ideal for frequent travelers who can maximize its benefits and offset the annual fee

Does Scapia credit card have lounge access?

Yes, the Scapia Credit Card does offer free airport lounge access, but with a minimum monthly spend requirement of Rs. 5,000.

So, if you travel frequently and hit that spend hurdle, you can enjoy some pre-flight pampering!

Is there an annual fee for Scapia card?

Yes, the Federal Scapia Credit Card has an annual fee of Rs. 499.

While not astronomical, it’s important to factor it in before applying, especially if you don’t travel frequently

What is the limit of Scapia credit card?

Unfortunately, Scapia credit card limits can vary significantly depending on individual factors like income, credit score, and banking partner.

Some users have reported limits as low as Rs. 20,000, while others have enjoyed limits exceeding Rs. 8 lakh.

The best way to determine your potential limit is to contact Federal Bank or directly apply for the card, as they evaluate each case individually.

My Scapia app is not working. What to do now?

You can try the following to address the issue in hand

- Check Google Play Store or the App Store for any App update.

- Go ahead & clear the app’s cache and data. This will certainly resolve issues related to corrupted data in your app/ phone.

- The Ramban (ultimate & last sulution) is to Uninstall and reinstall the app.

- Contact Scapia customer support at 080-48675100.

Is Scapia credit card real or fake?

Scapia is a real credit card launched in collaboration with Federal Bank in India.

However, it faces challenges like recent credit limit cuts and a lawsuit, so researching its pros and cons before applying is crucial.

Consider its strengths like zero forex markup and travel rewards alongside limitations like limited global acceptance and fewer premium offerings.

Make an informed decision based on your individual needs and spending habits.

LATEST POST

- Best Paper Trading Application In India

- Ashneer Grover Net Worth: Income, Wealth & LifeStyle!

- Stock Trading In India For Beginners: Step By Step Guide

- Vastu Shastra For Home: Boost Positive Energy Of Your Home.

- ESG Full Form || ESG Investing: A Complete Guide

2024 apartment Banking biography book review books Broking cards cibil score complete guide credit cards demat esg investment facts finance fintech flats forex governement schemes home home buying home loan investment loan mindset mind to matter mivan technologies mutual funds neobanks nri OC and CC p2p personal finance plots plots in lucknow reading habits real estate real estate terms retirement planning reviews stock market tax benefit taxes trading vastu